Case Study on Sole Proprietorship

Unlimited liability meaning that personal assets can be seized in case of bankruptcy or lawsuits against the business. Mike Adekunle was a young Nigerian businessman who received a sizeable inheritance from his late father and has decided to start a taxicab company in the popular city of Lagos Nigeria.

A Business Management Case Study Example with Solution.

. Southern Pacific Railroad 1886. What is Sole Proprietorship. The railroad was an expensive multi-year project that greatly changed and altered both the physical.

Advantages and Disadvantages. Disadvantages of Sole Proprietorship. A sole proprietorship is the easiest way to start a t-shirt business but the structure doesnt protect the owners personal assets from legal issues.

The other items that account for the change in owners equity are the owners investments into the sole proprietorship and the owners draws or withdrawals. Case Significance Summary Related Courses US History. A Sole proprietorship can be explained as a kind of business or an organization that is owned controlled and operated by a single individual who is the sole beneficiary of all profits or loss and responsible for all risks.

It also was a precedent-setting case in extending individual rights to corporations. Facts of the Case. The lowest start-up cost of the two options.

In this case Salomon transferred his business of boot making initially run as a sole proprietorship to a company Salomon Ltd that included himself and members of his family. This type of businesses is usually a specialized. The case was the first case in US history that asked fundamental questions about corporate entities and the protections they enjoy.

Imam Hossain Rubel D. Santa Clara County v. A recent study concluded that while the vast majority of married couples who separate will eventually divorce within three years approximately 15 May 02 2022 4 min read How Divorce Varies By State.

Salomon was paid the price of such a transfer by way of shares and debentures having a floating charge security against debt on the assets of. You can use any business losses to offset other sources of income like a salary from your day job or a spouse. This structure should only be used if you cant afford an LLC because shirt businesses have work and materials that can cause injuries.

500 is the typical filing fee - Easier to manage single-handedly. That means if something goes wrong you could lose both your printing company and your home. It is a popular kind of business especially suitable for small business at least for its initial years of operation.

As a new business Mike recorded a sizable amount of income even though the competition was. File your sole proprietorship incomes taxes by using Schedule C on your Form 1040 and adding the income or losses your business incurred to the other income you record. The income statement for the calendar year 2021 will explain a portion of the change in the owners equity between the balance sheets of December 31 2020 and December 31 2021.

Test Practice and Study Guide. Advantages of Sole Proprietorship. But be careful not to step into hobby business territory with the IRS.

PPrrooppoosseedd BBuussiinneessss LLeeggaall SSttaattuuss Although the legal status of business tends to play an important role in any setup the proposed Auto Repair Service Workshop is assumed to operate on a sole proprietorship basis which may extend to partnership in case of addition of new.

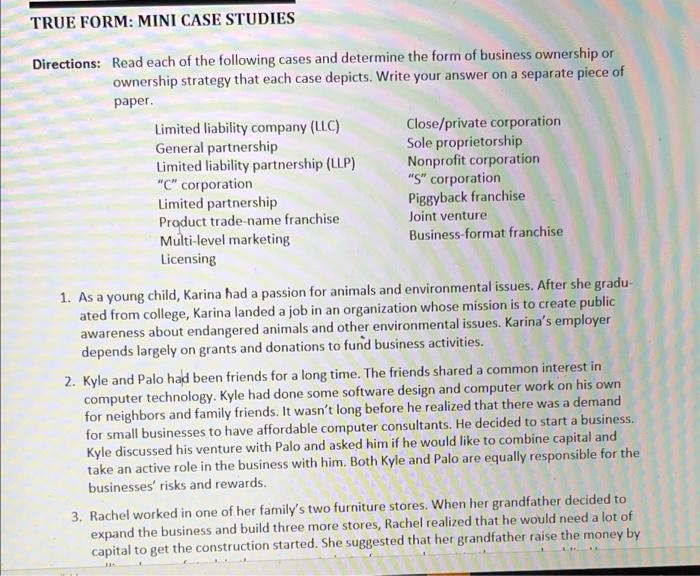

Solved True Form Mini Case Studies Directions Read Each Of Chegg Com

Pdf Sole Proprietorship And Tax Implication In Harris International Limited Rehama Kampala Uganda

Quiz Worksheet Sole Proprietorship Ethics Case Study Study Com

Pdf The Situations Of Sole Proprietorship E Commerce Entrepreneurs And Trends In Their E Commerce A Case Study In Thailand

0 Response to "Case Study on Sole Proprietorship"

Post a Comment